unrealized capital gains tax bill

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income. Though its on-paper value might fluctuate during.

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Currently taxpayers pay tax only on realized capital gains in other words when the asset is sold and you bank a profit.

. With their latest tax proposal Democrats are going after an elusive target. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds. If you decide to sell youd now have 14 in realized capital gains.

Unrealized Capital Gains are Not Part of Income. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. In 2022 those rates range from 10 to 37.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. If youve ever wanted to learn more about the unrealized capital gains tax youre not. Biden Expresses Support for Annual Tax on Billionaires Unrealized Gains Proposal is among provisions Democrats are pursuing to pay for proposed 35 trillion spending plan.

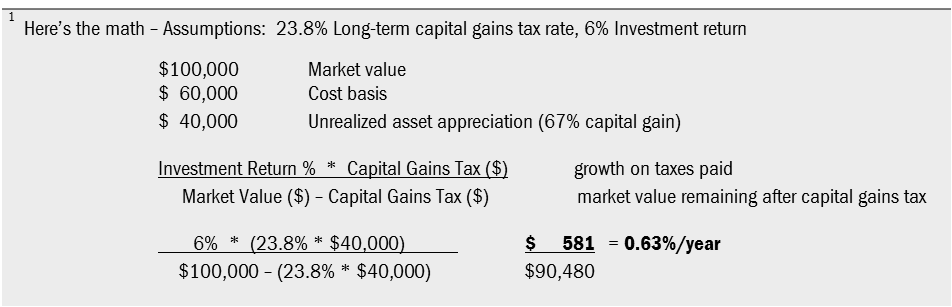

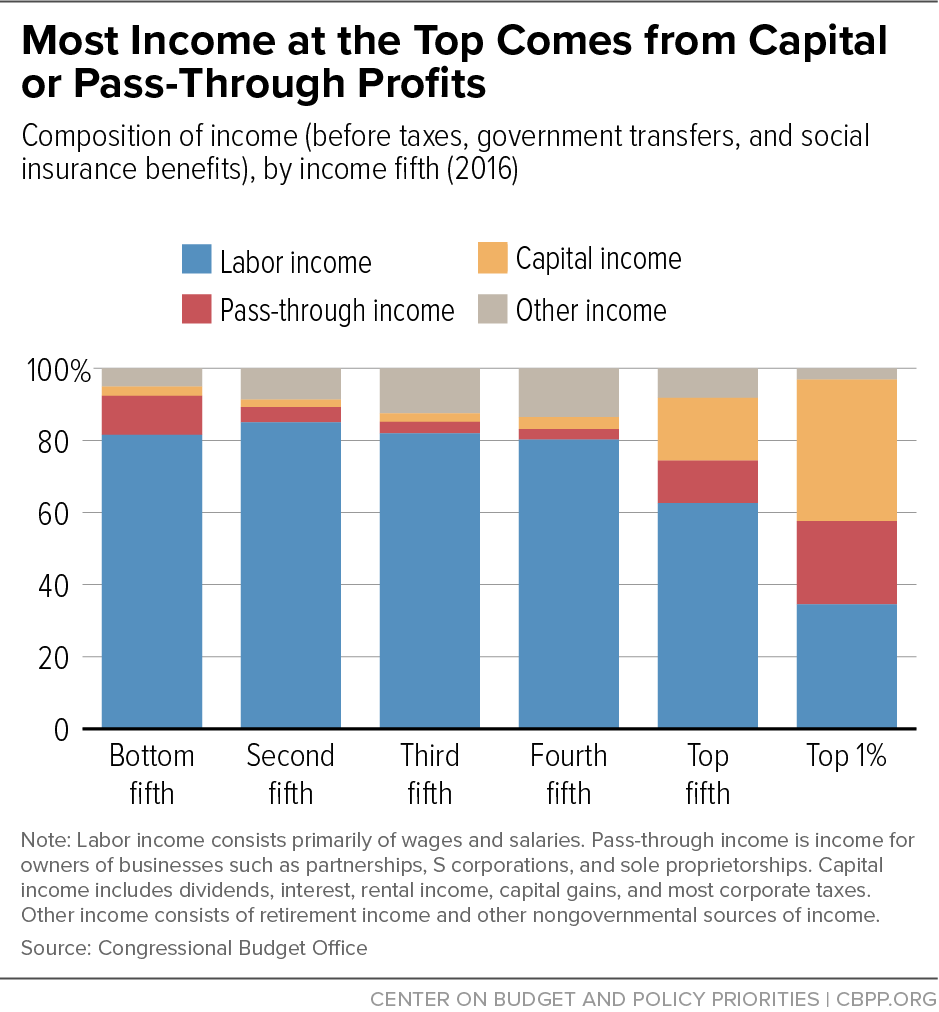

When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages. Just imagine that you paid 1000 to purchase a stock this year and on December 31 2021 it is valued as 2000 based on then. Unrealized gains are for lack of a better term unrealized.

The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation on. Ron Wyden D-OR chairman of the Senate Finance Committee introduced legislation on Wednesday requiring taxpayers with more than 1 billion in assets or more than. Taxing unrealized gains is effectively the.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on. In reality it is a tax on wealth.

Short-term capital gains are taxed at your ordinary tax rate. Billionaires and their growing piles of untaxed investment gains. That means asset holders havent benefited from them in any material way yet.

Such a tax is really a tax on wealth. To increase their effective tax rate to. Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social and climate.

The largest part of the tax bill will be upfront. If you hold an asset for more than one year before you sell for a capital gain.

Don T Try To Mark To Market Capital Gains Tax Unrealized Gains At Death Instead Tax Policy Center

U S President Biden Unveils Unrealized Capital Gains Tax For Billionaires Swfi

High Class Problem Large Realized Capital Gains Montag Wealth

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

The Billionaire Minimum Income Tax Is A Tax On Unrealized Capital Gains Coming Ramseysolutions Com

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

Realized Vs Unrealized Gains And Losses What S The Difference Marcus By Goldman Sachs

Crypto Tax Unrealized Gains Explained Koinly

State Taxes On Capital Gains Center On Budget And Policy Priorities

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Unrealized Capital Gains Tax What Is It Churchill

What Are Capital Gains Taxes And How Could They Be Reformed

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Capital Gains Tax What Is It When Do You Pay It

Deferring Capital Gains Potential Benefits Russell Investments

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)